Welcome back to the Aviation Insurance Blog!

When an agricultural aviation operator gets an angry call from a customer, the last thing he wants is to worry about whether he has the proper liability coverage for the potential loss. There are different types of liability coverage available, so it is essential to understand which coverages are on your policy. This article will outline the basic types of liability coverages, some of the key exclusions and several available endorsements for an agricultural aviation insurance policy.

Liability is the condition of being legally liable to a third party for damages caused in whole or in part by you. Insurance policies respond in two ways when you become legally liable: 1) the policy pays the damages you are legally obligated to pay up to the coverage limit, and 2) the insurer provides a legal defense, until the limits of liability are exhausted. The legal defense costs are separate from the liability limits in agricultural aviation policies and can often incur much higher expenses than paying the actual claim.

There are two basic types of liability coverage on an agricultural aviation insurance aircraft policy: 1) Non-Chemical (Aircraft) Liability, for third-party bodily injury and property damage not by chemical application, and 2) Chemical Liability for damage resulting from the aerial application or chemicals. Many refer to Chemical Liability in slang as “drift insurance.” Chemical Liability has several options and unique exclusions.

The three chemical liability category options:

- Comprehensive Chemical – provides coverage for liability incurred out of the aerial application of seeds, fertilizers, or any chemical except Picloram. * (some policies also add after “except Picloram,” “or any defoliant or desiccants applied in dust form; or any inorganic arsenical compound, except arsenic acid used in liquid spray form as a cotton desiccant or defoliant.”)

- Restricted Chemical “RC”—provides coverage for liability incurred out of the aerial application of seeds, fertilizers, insecticides, or fungicides only (sometimes rodenticides are also included in the RC definitions).

- Excluding Chemical “XC”— provides coverage for liability incurred out of the aerial application of seeds and fertilizers only.

*Operators can purchase a write-back endorsement providing coverage for liability incurred out of the aerial application of Picloram (Tordon, Grazon).

In the realm of agricultural aviation, the application of pesticides and crop protection products through aerial methods is a critical task for maintaining plant health and effectively managing natural resources. As a result, understanding the complexities of aerial pesticide application, including the impact of droplet sizes, spray drift, and the specific requirements stated on product labels, is essential for agricultural aviation operators in the United States and beyond.

When an agricultural aviation operator receives a complaint, possibly related to spray drift affecting public health or neighboring crops, the last thing they want is to worry about whether their liability coverage is adequate for the potential loss. This is particularly pertinent considering the stringent regulations set by the Department of Agriculture in countries like the United States and South Korea. Over the past 20 years, there has been a significant evolution in application technologies, emphasizing the need for operators to stay informed and adequately covered.

This article outlines the basic types of liability coverages, some key exclusions, and several available endorsements for an agricultural aviation insurance policy. We will delve into how these factors intersect with the broader concerns of spray applications in agriculture.

Liability Coverage in Agricultural Aviation: A Closer Look

Liability is the state of being legally responsible to a third party for damages caused wholly or partly by you. When legally liable, insurance policies respond in two ways: 1) by paying the damages you are obligated to pay up to the coverage limit, and 2) by providing a legal defense, until the liability limits are exhausted. It’s crucial to note that the costs of legal defense in agricultural aviation policies are separate from the liability limits and can often incur much higher expenses than the actual claim.

Basic Types of Liability Coverage:

- Non-Chemical (Aircraft) Liability: This covers third-party bodily injury and property damage not related to chemical application.

- Chemical Liability: This is crucial for damage resulting from aerial pesticide application. Often referred to informally as “drift insurance,” it is vital in managing risks associated with spray drift and ensuring adherence to product labels and public health standards.

Chemical Liability Category Options:

- Comprehensive Chemical Coverage: This includes liability from the aerial application of seeds, fertilizers, or most chemicals, except for specific exclusions like Picloram.

- Restricted Chemical (RC) Coverage: Covers liability from aerial application of seeds, fertilizers, insecticides, or fungicides, and sometimes rodenticides.

- Excluding Chemical (XC) Coverage: Applies to liabilities from aerial application of seeds and fertilizers only.

Note: Operators can purchase a write-back endorsement for coverage of excluded chemicals like Picloram (Tordon, Grazon).

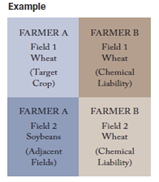

These categories apply to claims arising from aerial applications on properties not owned by the operator or their client. For instance, if drift damage occurs to a neighboring field during a spray application, the policy would typically cover this damage. However, coverage nuances, such as spraying the wrong field or using incorrect chemicals, require additional endorsements like Target Crop and Adjacent Fields.

Additional Considerations:

- Farmer, Owner, Grower Endorsement: Sometimes, a farmer or contract issuer may require being named as an additional insured on the operator’s policy. While this meets certain contractual requirements, it’s important to consider the implications on the limit of liability.

Stay tuned for our next installment, where we will explore key exclusions found in aerial application insurance policies and how they relate to the broader concerns of spray applications, public health, and environmental stewardship in agriculture.

DISCLAIMER: These episodes are for educational purposes only. Due to the changing regulatory and legal nature of this business, especially concerning the Department of Agriculture in various countries, some information may change over time. Having a knowledgeable and experienced aviation insurance broker on your team is crucial for success in business and for effectively managing aircraft and aviation business risks, including those related to the application of pesticides and crop protection products.